Engage Your Money Power: Closing the Gap Between Values and Investments

Everyone’s talking about the Great Wealth Transfer — and rightly so. Over the next four years, women are projected to control over $30 trillion in assets. But talking is not enough. What’s missing is clear action — and a collective push to ensure women are fully engaged, confident, and investing in ways that reflect their values.

As I shared in a previous piece, What Can Women Do to Align Their Investments with Their Values, there’s still a significant gap between women’s financial engagement and the potential for collective impact. While women are often leading in philanthropy, many remain on the sidelines when it comes to activating their investments to build the world they want to see.

This article is a call to action — and a curated guide. It offers practical, community-driven classes and resources to help women (and the conscious humanist men who walk beside us) step into their financial power. The truth is: Investing is not as hard as we’ve been led to believe, and when we step up, we not only grow our wealth, we can begin to close the racial and gender equity gaps that persist across society.

According to UBS’s 2025 Matriarchs on the Rise study, two key challenges persist:

“Women consistently underestimate their own abilities while overestimating what is required to be financially involved.”

“Education and access close the confidence gap. While 74% of women don’t consider themselves knowledgeable about investing, educational efforts significantly improve confidence.”

That insight is not new to me, and it drives the work I do every day. Over 15 years ago, I learned that less than 1% of money moves through philanthropy — compared to the scale of the capital markets. At the same time, only 1.6% of philanthropic dollars (currently approximately $500 billion) were directed to women and girls — a fact that is still true today.

I realized we needed to shift the paradigm and amplify more changemaking strategies across the full spectrum of capital. Hence, changing my company name to Changemaker Strategies (from Imagine Philanthropy). Since then, I have been advocating for women to use not just our donations, but our investments to create meaningful social impact.

Women investors have a broader vision. As McKinsey’s The New Face of Wealth: The Rise of the Female Investor reports, women are focused on achieving goals in addition to returns. And those goals can span critical areas that matter to many women:

Economic security,

Leadership advancement,

Capital for women entrepreneurs,

Equity across supply chains,

Climate justice, and more.

We don’t need to wait for perfect conditions. In a world filled with so many challenges beyond our direct control, how we interact with our money is one place we can drive real change. I’ve seen this firsthand in my work coaching women to take one small step each month to engage with their investments. And I’ve seen how learning in community can unlock confidence and clarity.

I have created this summary of learning spaces, courses, and communities where women can step into their money power by building financial fluency, sharing wisdom, and moving from intention to action. It doesn’t include the many offerings from donor networks, nor does it include banks or traditional wealth advisors — rather, it focuses on values-led leaders who are creating spaces designed for and by women.

The table is organized into community and coaching groups, cohort trainings, circles and classes, and professional networks and resource hubs, providing an overview of various initiatives supporting women’s financial empowerment and involvement in the community and in capital markets.

Read on and find a place for you to engage your money power, and let me know what sparks for you! The table has many more opportunities, and also the particulars for the groups. I know these people. I am working with them. And I believe they offer powerful entry points for you on your learning and money power journey.

1. Invest for Better’s Purposeful Wealth Class

Sign up today for a transformative seven-session course starting in September!

Purposeful Wealth is a seven-session program created by Invest for Better for high-net-wealth women donors who want to align their capital with their values. Co-facilitated by yours truly, Tuti Scott, Lauren Sercu, and joined by the Radiant Strategies team, the experience blends depth with practicality through values-based financial decision-making, investing strategies, and conversations with key stakeholders. Participants receive a thoughtfully designed workbook and actionable class materials.

The program runs biweekly on Mondays from Sept 15 to Dec 8, 10:30 am–12:00 pm PT / 1:30–3:00 pm ET. Tuition is $1,500, including all materials. Register here.

2. Aligning our Values and Money Moves

Full disclaimer — this is an event my firm, Changemaker Strategies, produces, and Gwendolyn VanSant and I would love to support you as part of our beloved community. Join us September 26–28 at the beautiful OMEGA Institute in Rhinebeck, N.Y.

3. Trauma of Money

Life-changing course I got to do with 56 hours of incredible content that stretched my mind and heart. Now Chantel Chapman has a book out! You can get a free speaking event if you do a book bulk order by September 8th. See full details here and order now!

4. Freedom School for Philanthropy

I have had the honor of working alongside Freedom School for Philanthropy and the Radiant Strategies team for six cohorts. Stay tuned for details on an April 2026 women’s cohort launch.

“For philanthropists ready to wrestle with the human and strategic issues behind our work, FS4Ph is an invaluable experience! The leadership team’s experience and skill are exceptional — I am hard pressed to think of any group of people I have worked with in the course of my career that is so accomplished and able, yet so patient and empathetic.” Cohort member.

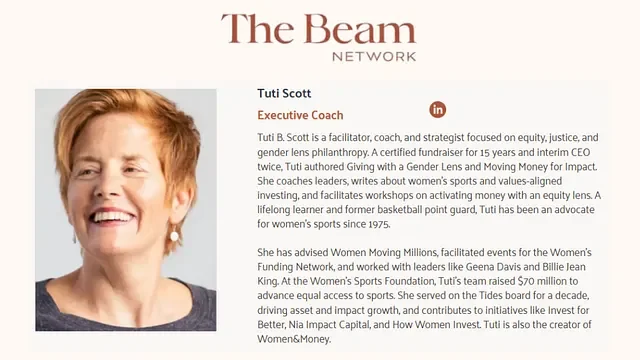

5. The Beam Network

I am one of the coaches involved with this fantastic community.

Press enter or click to view image in full size

“The Beam Network’s content and community allow me to build a healthier relationship with wealth by demystifying investment. With every class, I feel more confident to explore the various levers I have to shape my finances in a way that fits with my values.” — S. London

6. The Impact Collective

I can’t say enough about how critical it can be for our world when white women of wealth examine their power and privilege and move to action. Jump into this work with a November retreat happening in the Bay Area.

As founder Julia Johannsen explains, “I founded the Impact Collective because I wanted to shift from LEARNING to DOING.”

7. We Are Enough

Simple step! Take the pledge to invest in women! AND have access to innumerable opportunities across every asset class to drive gender equity with your dollars.

“We are taking the pledge to invest in women-owned businesses because it promotes equality, drives innovation, and fosters inclusive economic growth. We believe that investing in women is a way to harness untapped potential and contribute to a more equitable and prosperous society.” — Beverly B. Jr. & Beverly Beal-Hogan Sr, Business Owner

8. Our Money Ourselves

Our Money Ourselves, housed at the Just Economy Institute, this past February gathering had spectacular energy and speakers. Looking forward to what comes next here, and consider joining the Women, Money, and Transformation gathering to dive deep into the purpose of wealth.

9. SheMoney

SheMoney, founded by Jacki Zehner — the first female trader and youngest woman to make partner at Goldman Sachs — is a content platform and consultancy advancing financial wellness for both individuals and organizations. Join the community and mailing list to stay connected to future programs and opportunities to engage.